Investment Strategy

Focus Areas

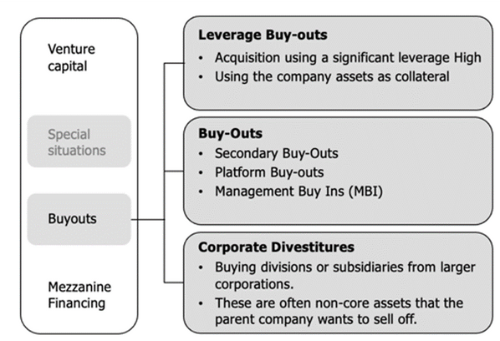

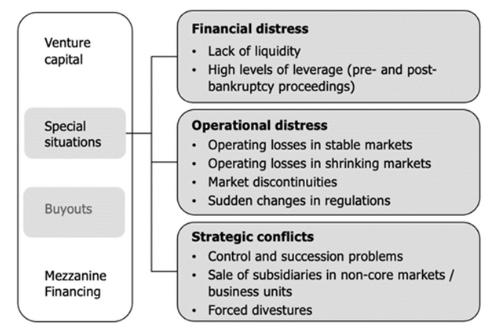

We focus on control investments in lower middle market companies and distressed opportunities across various industries, including manufacturing, healthcare, technology, and consumer goods. Our target investment range is between $5 million and $50 million with companies between 10M and 100M revenue

Criteria

We invest in businesses where our bespoke approach to the unique profile of every business can be instrumental to the success of the business.

We understand that no business is like the others and requires a tailored approach to be successful.

Preferred investment include one or more of the following criteria:

- Execution of ambitious growth plan

- Unlocking value through execution excellence

- Shift in customer profile, resolving customer concentrations

- Corporate carve-outs requiring completion of the company structure

- Businesses with limited access to capital markets due to customer profile, performance or other challenges

Approach

Our approach combines rigorous due diligence, strategic planning, and hands-on management. We work closely with our portfolio companies to develop and execute tailored growth strategies, ensuring long-term success and value creation.